Vandenberg Air Force Base’s 28-Megawatt Solar Power System from SunPower Now Fully Operational

Lompoc, California. The power generated by the system is expected to meet about 35 percent of the base’s energy needs. “Access to reliable, resilient electricity to meet operational needs is a priority for the U.S. Air Force, and this solar project enables us to increase our own energy security […]

Click here to view original web page at www.prnewswire.com

“Access to reliable, resilient electricity to meet operational needs is a priority for the U.S. Air Force, and this solar project enables us to increase our own energy security at Vandenberg with competitively priced, dependable solar energy from SunPower,” said Ken Domako, Chief of Portfolio Optimization at Vandenberg Air Force Base.

The base will purchase electricity under a 25-year power purchase agreement, providing Vandenberg with competitive, fixed electricity rates, and the Air Force will retain all of the associated environmental credits. Alabama-headquartered Regions Bank provided the capital required for the solar project, eliminating the need for capital expenditures by the Air Force. Cornerstone Financial Advisors, LLC served as financial advisor to Regions Bank on this transaction.

The onsite system is the largest Air Force solar project in which the Air Force consumes all of the energy produced.

“The Air Force is committed to incorporating modern, clean energy technology like solar to provide diverse energy sources for our warfighter,” said Dan Soto, Air Force Civil Engineer Center rates and renewables division chief. “With support on this project from solar technology innovator SunPower, we’re improving energy resiliency, optimizing demand, and assuring supply at Vandenberg over the long term.”

The project features SunPower® Oasis® power plant technology which is a fully-integrated, modular solar power block system engineered for rapid deployment and land use optimization. The Vandenberg system is generating solar electricity from land that has gone unused for over decade and is a former Air Force housing site. The system is expected to provide 54,500 megawatt hours of energy annually – equivalent to offsetting carbon dioxide emissions from 8,600 cars for one year according to the U.S. Environmental Protection Agency.

“Our government customers clearly understand the environmental and economic value in transitioning from traditional to renewable energy sources, and SunPower is pleased to support the U.S. Air Force’s progress with our high-performing solar technology,” said Nam Nguyen, SunPower executive vice president, commercial solar. “With a SunPower system designed to cost-effectively maximize power generation, Vandenberg can expect to see energy savings for decades.”

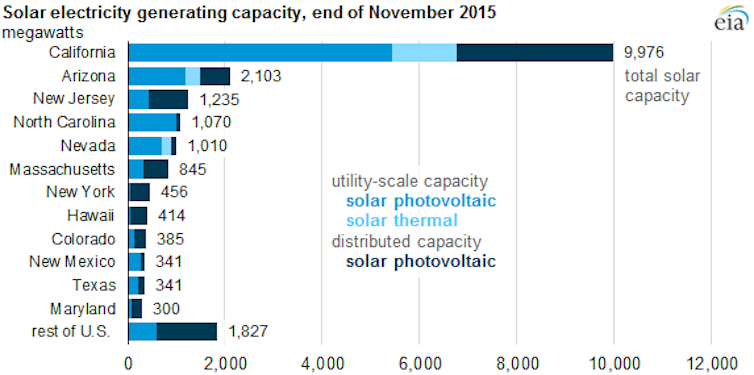

SunPower is a solar advisor to various federal government agencies, deploying solar power systems at military facilities nationwide including more than 28 megawatts at Nellis Air Force Base in Nevada; 10 megawatts of solar and 1 megawatt of energy storage at the U.S. Army’s Redstone Arsenal in Alabama; 13.78 megawatts at Naval Air Weapons Station China Lake; as well as 5.6 megawatts at the Air Force Academy in Colorado Springs.

About SunPower

As one of the world’s most innovative and sustainable energy companies, SunPower (NASDAQ: SPWR) provides a diverse group of customers with complete solar solutions and services. Residential customers, businesses, governments, schools and utilities around the globe rely on SunPower’s more than 30 years of proven experience. From the first flip of the switch, SunPower delivers maximum value and superb performance throughout the long life of every solar system. Headquartered in Silicon Valley, SunPower has dedicated, customer-focused employees in Africa, Asia, Australia, Europe, and North and South America. For more information about how SunPower is changing the way our world is powered, visit www.sunpower.com.

SunPower’s Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding project plans and timelines, relative generating capacity, projected energy output, and expected cost savings. These forward-looking statements are based on our current assumptions, expectations, and beliefs and involve substantial risks and uncertainties that may cause results, performance, or achievement to materially differ from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: regulatory changes and the availability of economic incentives promoting use of solar energy, challenges inherent in constructing and maintaining certain of our large projects, competition and market conditions in the solar and general energy industry, and fluctuations or declines in the performance of our solar panels and other products and solutions. A detailed discussion of these factors and other risks that affect our business is included in filings we make with the Securities and Exchange Commission (SEC) from time to time, including our most recent report on Form 10-K, particularly under the heading “Risk Factors.” Copies of these filings are available online from the SEC or on the SEC Filings section of our Investor Relations website at investors.sunpowercorp.com. All forward-looking statements in this press release are based on information currently available to us, and we assume no obligation to update these forward-looking statements in light of new information or future events.

© 2018 SunPower Corporation. All Rights Reserved. SUNPOWER, the SUNPOWER logo and OASIS are registered trademarks of SunPower Corporation in the U.S. and other countries as well.

SOURCE SunPower Corp.