Why SunPower Corporation’s $568.7 Million Loss Isn’t as Bad as It Seems

Solar tariffs have been the headline story for SunPower Corporation ( NASDAQ:SPWR ) for almost a year now. The Trump administration’s 30% tariff on solar imports will impact SunPower more than most solar manufacturers because of its premium-priced products and focus on the U.S. as an end market. What […]

Click here to view original web page at www.fool.com

What fourth-quarter 2017 results told us was a lot more about SunPower’s strategy for the future than the impact of tariffs. In fact, the decision to focus more on component sales could have a much bigger impact on the company’s finances over the next year. And it’s those underlying results that are more important than the accounting that drove a $568.7 million loss in the quarter.

Fourth-quarter headline numbers

On a non-GAAP basis, fourth-quarter revenue was $824 million, gross margin was 11.9%, and net income was $35.8 million, or $0.25 per share. Results were in line with guidance for $800 million to $850 million of revenue and gross margin of 13% to 15% (once you account for one-time margin costs related to tariffs).

The one-time costs were related to bringing solar panels into the U.S. to avoid tariffs. Management said they have between three-and-a-half and six months of solar panels to fill U.S. demand, which means the company could last into the summer with tariff-free solar panels.

There’s also a process to evaluate products that should be excluded from tariffs, which SunPower will seek. Management said they expect to complete the exclusion application in the next month, and after a 30-day public comment period, the decision should come soon after.

Why SunPower’s loss is misleading

SunPower’s $568.7 million loss on a GAAP basis is what gave some in the investing community a little heartburn. But it has more to do with the strange accounting in the solar industry than anything else.

Management made the decision in the fourth quarter to sell about 45,000 solar leases, which are backed with $1.4 billion of long-term contracted payments. They anticipate the proceeds to be about $200 million in cash and the buyer will assume or pay off $436 million of debt for total proceeds of $636 million.

This decision led SunPower to re-evaluate whether leases were properly valued on its balance sheet. Based on accounting rules when the leases were distributed, SunPower had put the contracted payments on the balance sheet at a very low discount rate (based on real estate rules), which was lower than the 7% or 8% ballpark rate the leases are being sold for. The difference resulted in a $474 million charge to write down the assets on the balance sheet. It’s accounting, not fundamental weakness in the business, that drove the massive loss in the fourth quarter.

The sale of leases is part of a larger strategy to exit the project finance business. SunPower wants its business to be almost entirely the sale of solar panels and solutions in the future. That’ll make its income statement easier to read in the long term, but will lead to some odd accounting in the short term.

Distributed generation is still the name of the game

The residential and commercial solar business continued to be the highlight for SunPower. Residential revenue was $174.3 million with a gross margin of 16.7%. Commercial revenue was $318.2 million with a gross margin of 9.9%. But management also said residential and commercial margins were negatively impacted by about 4 and 2 percentage points, respectively. Without that, margins of around 21% and 12% would have been in the ballpark of what investors should expect long term.

SunPower also said it expects to gain market share in the U.S. residential and commercial markets in 2018, which is a bit of a surprise given the impact of tariffs. But the company wants to keep a big presence here, and that’s probably a good move in the long run, even if it sinks margins in the near term.

Power plants are growing, but not very profitable

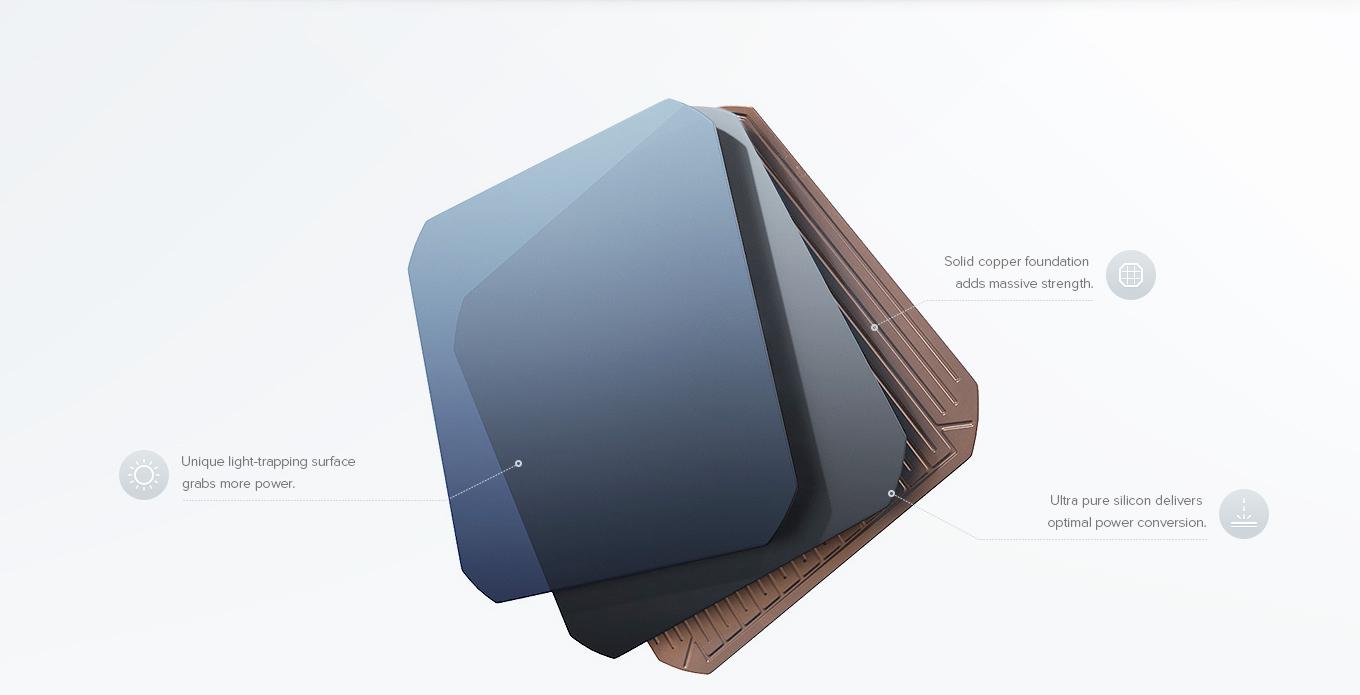

The distributed solar business is SunPower’s bread and butter, but power plants are what could drive its long-term profitability. Power plant bookings for 2018 exceed 600 MW, and during the year nearly 1 GW of P-Series solar panels will be produced in China and Mexico.

I say this is the growth business because management expects to exit 2018 with about 2 GW of P-Series capacity, which will drive growth into 2019. Power plants won’t generate the revenue per watt or margin of a residential or commercial solar business, but 1 GW of sales could drive $600 million of sales or more, potentially doubling in 2019.

SunPower is a company in transition

The income statement and balance sheet will continue to be in flux in 2018 as SunPower sells assets like leases and its stake in 8point3 Energy Partners (NASDAQ:CAFD). But the company could reduce debt from $1.55 billion at the end of 2017 to around $811.1 million just from paying off 2018 convertible notes and reducing lease debt.

The next step for SunPower will be growing the power plant business and adding energy storage to more residential and commercial installations, which will drive incremental revenue without adding manufacturing capacity. If it can do that with strong margins, the company could return to sustainable profitability by the end of 2018.

*Stock Advisor returns as of February 5, 2018